The $1K Pay Off Challenge

/For those of you who don’t know, I’ve been on a journey to Financial Freedom for 1.5 years now!

Last year was my #12MonthsOfLess and one big “Less Goal” I had was #LessDebt. I read Dave Ramsey’s book “Total Money Makeover” and have been following the baby steps since.

If you are unfamiliar with the baby steps, I created a video during my year of less that explains it in more detail. Check it out here!

Essentially, there’s 7 steps and you go in order to become financially free :) See graphic!

Right now, I am on Baby Step #2 (Pay off debt). When you are in Baby Step #2, you’ll want to list your debt from smallest to largest to pay it off. Last year, I paid off my Chase Freedom Credit Card ($5,500). Since then, I’ve been working toward paying off my Kia Soul, otherwise known as “Pearl” ($12,655 balance at the beginning of 2018).

I’m going to be real honest with y’all.

My goal to pay off my car by then end of the year has been on the back burner for several months now. (The balance has been in the $3K range now since April). I feel like I’ve been crushing it at a lot of other things, but this goal has been hiding out. It’s not that I’m going more into debt (I refuse to do that to myself again). But I haven’t been as good with taking my extra money and using it to pay off my smallest debt as fast as possible. I haven’t been sticking to the original budget I created at the beginning of the month.

You see, last month, I budgeted $750 to put toward my car. How much did I actually pay in July? This is embarrassing to admit, but I didn’t pay a single dime. It’s the little things here and there that add up. Before you know it, the $750 I thought I had to payoff my car was gone.

It’s always the little things, too…

The $25 new patio umbrella

The $35 spent at Ulta on shampoo / conditioner during their semi-annual Liter sale

The $30 spent on rock painting supplies

The $35 spent to cure my Poison Ivy

The $40 campsite

The $150 Ring Doorbell purchased during Amazon’s Prime Day sale

The $150 spent at Target on clothes, a tent and who knows what else….

The $20 Chris Young ticket

The $30 kayaking trip

The $109 spent out to eat (Chinese, Dominoes, ChikFilA, Skyline, Mother Bears, Rick’s Boatyard)

The $25 on a Tribe sweatshirt

The $50 on an Anniversary gift for J

The $6 on a fun, handcrafted birdhouse to add to my tree

The $35 spent on a wedding gift

The $16 Audible subscription I forgot to cancel before it renewed

ADD those together and what do you get…

$756 — Literally the amount I was going to put toward my car 😞

I knew I had spent a little extra, but I had no idea until the end of the month when I kept “balancing” my EveryDollar budget with what I spent and taking my Pearl Payoff amount down to $0. Ashley, it’s about time for a WAKE UP call!

ASK AND YOU SHALL RECEIVE

Last week, an email for $1,000 Pay Off Day came into my Inbox. What timing!

Dave Ramsey and his team put together a challenge to encourage others to commit to pay off $1,000 toward their smallest debt during the month of August. Um, GENIUS! Getting a community of people together to work toward a common goal of becoming DEBT FREE. HECK YES! Count me in!

The bonus?!

4 winners who complete the challenge will win $2,500.

I thought, “Wow! If I pay off $1K and win the $2,500, my Kia Soul will be paid off!!! How amazing would that be. Even if I don’t win, I will be $1K closer to getting Pearl paid off this year.”

I told myself, “This will be tough, but it’s definitely attainable with discipline and a bit of extra work! And if I can achieve this, it will put me back in the right mindset to tackle my debt with gazelle intensity.”

Here’s what I’m doing to GET MY BUTT back in GEAR:

CASH ENVELOPES vs. Debit Card

I am headed to the bank first thing tomorrow morning to get cash out! I’ll be using dollar bills for my purchases this month. The only thing I will use my debit card for are bills online.

Last year, I used the cash envelope system and it really did help me not overspend. When the money is gone, it’s gone!

Here’s the categories and the $$ I’m allocating to each this month:

Groceries: $200 (major decrease from my usual $300 budget)

Out to Eat: $30

Gas: $120

Fun: $50

Mini Trip to FL: $150

SHELF COOKING + GROCERY SHOPPING

One of the categories I spend the most money outside of my mortgage is FOOD. Food is technically a “necessity” but that doesn’t mean I need to buy whatever I want when I go to the grocery store.

I know part of it, is I try to eat more WHOLE FOODS and those are more expensive. However, what I’m going to do this month is make meals with WHAT I HAVE in the house. AKA Shelf Cooking or what some may call Pantry Cooking! We’ll see how thin I can stretch my dollar and how little I can spend at the store this month!

For the fresh produce and staples we need, I’m going to try going back to Aldi and see how that goes! I enjoyed it last year, but somewhere along the way, I got in the habit of just making one stop at Kroger and calling it good.

USE EVERY DOLLAR. THE RIGHT WAY.

So the thing is, I use Every Dollar (budgeting app) each month. But I’ve been really bad about tracking everything and then moving money around to make it “work” after the month has begun or once the month is over.

Here’s to making NO changes to budget UNLESS it’s adding money toward debt. I think the cash envelopes will also majorly help with this!

SIDE HUSTLE FOR EXTRA $$$

I have a feeling I’ll be pulling out my handy, dandy Lyft stickers again to earn some extra dough! From the looks of my budget, I’m going to need a little bit of extra money to hit the $1,000 mark.

Dave Ramsey’s team have been sending tips on how to make extra money, too. They’ve suggested things from driving (Uber / Lyft) to pet sitting (Fido) to delivering Pizzas to working overtime (if your job allows). There’s plenty of opportunities out there! You just need to make the time for them!

NO: THE MOST POWERFUL 2-LETTER WORD

When it comes down to it, saying NO can make the most impact on spending LESS.

NO to the Starbuck’s run

(Those small purchases really do add up!)NO to going out to eat after a long day at work

(You have a fridge of food waiting for you at home! Make something easy!)NO to buying the pup another toy

(Let’s be real, he has plenty as it is)NO to the trip to Target

(Don’t even tempt yourself by stepping foot inside!)NO to ALL of the social activities

(Tip: You can still do things with your friends, but maybe suggest activities that cost little-to-no money like a hike or painting kindness rocks or making an effort to eat BEFORE you go out)

Find a Community of Like-Minded People

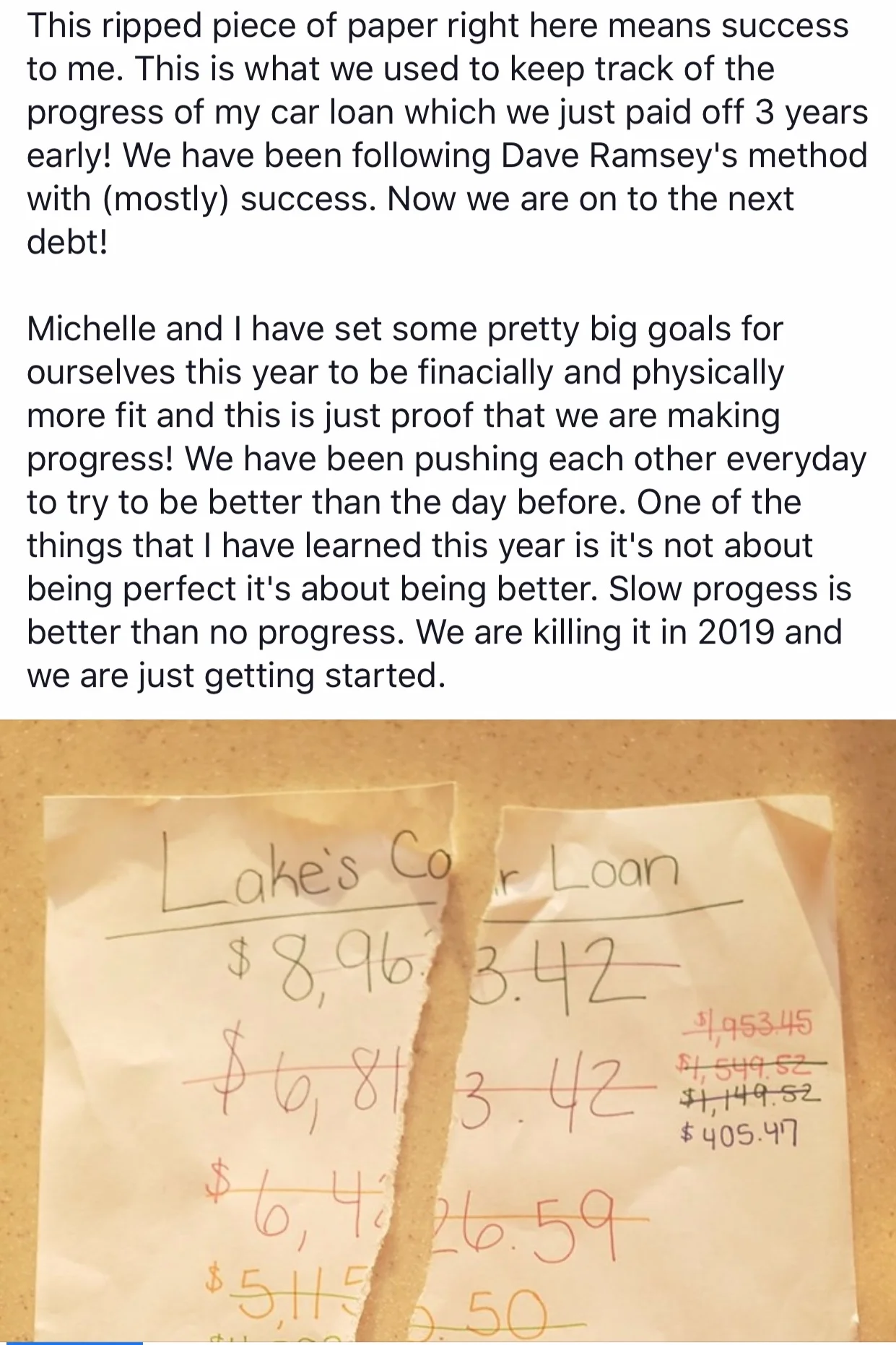

The other thing that has really helped me with completing things like the #Whole30 or exercising on the daily is surrounding myself with a community of people who are reaching toward the same goals. For instance, my friend Michelle and her husband Lake just paid off their car!!! Something about seeing their faces filled with enthusiasm and the ripped up debt paper makes me want to get mine paid off AS FAST AS POSSIBLE, too!

If you aren't sure where to get such support + inspiration, use Facebook groups! I’ve had the most success joining a Dave Ramsey group, a Lyft Drivers group, a Whole30 group, etc. These people are in it to win it. You can ask questions to get help! You can stay inspired through other people’s success stories, much like Lake and Michelle’s.

Also, for the $1,000 Pay Off Day specifically, the Dave Ramsey team has created a Facebook event.

Click here and check out the discussion tab to follow along!

The other thing that may help out?!?

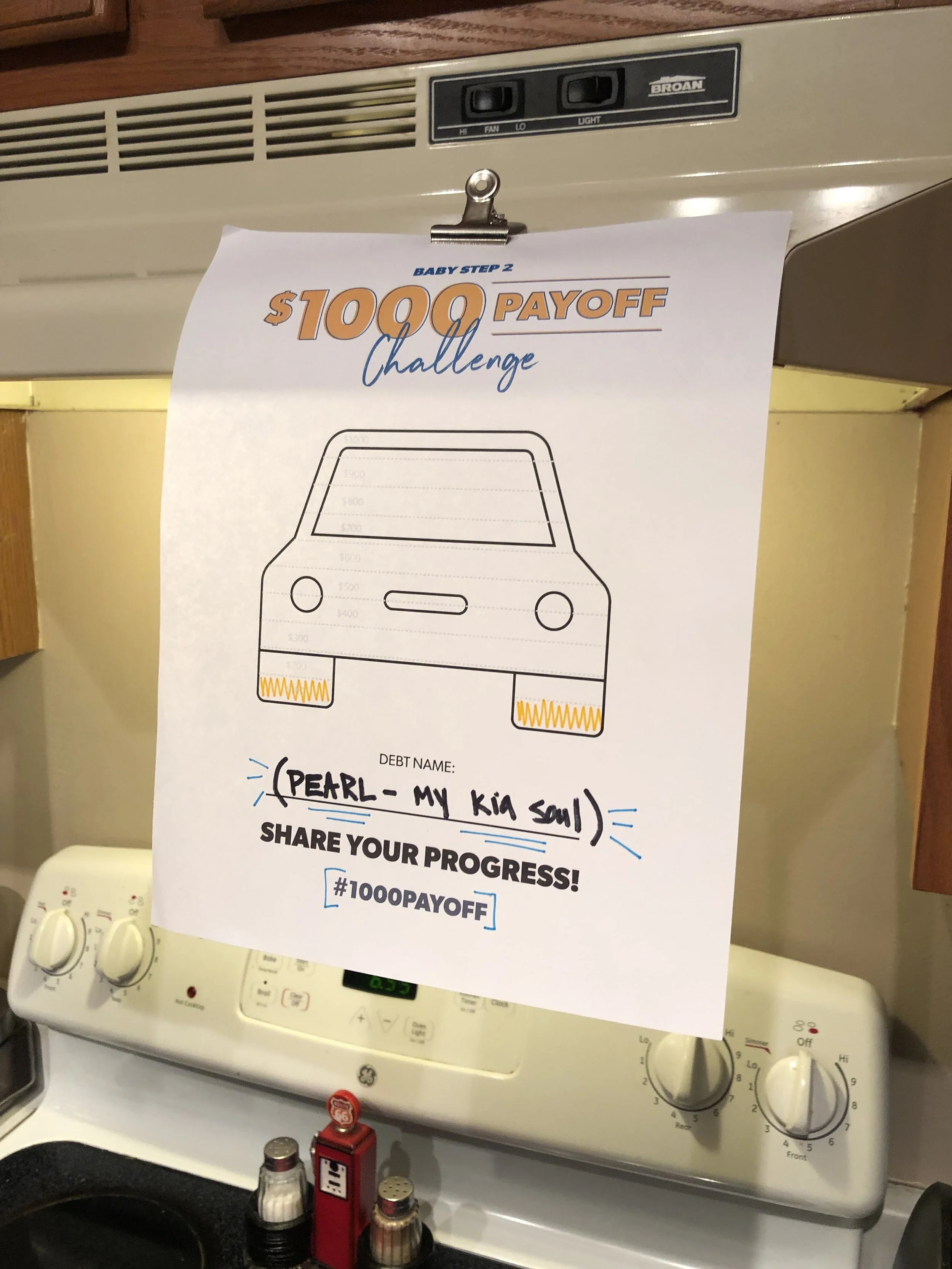

VISUALS!

You see, when you sign up, you will have access to 4 graphics (almost like coloring pages) that you can use to keep track of your progress. I have mine printed off and hanging above my stove. I see it everyday here and it reminds me to stay committed to what I set out to do!

They also have mobile version if you prefer that! There’s one in the shape of a car, one in the shape of a graduation cap, and two more general boxes for you to use for any other debt you may have!

Do you want to participate in $1K Pay Off Day?

If it’s still August 2019 when you’re reading this, there’s still time to join!

Head here to sign up today!

And even if it’s after the “official Dave Ramsey #1000PayOff day”, that doesn’t mean you can’t create your own in whatever month you choose!

When you want something bad enough, you’ll make it happen! By August 31st, the car on my coloring page is going to be FILLED with colors and I will be $1K closer to having Pearl paid off! I’m going to make it happen!!! Are you?!?!

Let’s! Do! This!

PS - This is in no way an ad or sponsored post (though if it was, I could put it toward my debt snowball, right?! Hahah). Dave Ramsey and the #7BabySteps method he created is something I truly believe in. It totally works! If you listen to his podcast or follow him on YouTube, you’ll hear countless success stories and debt free screams. If they can do it, you can do it, too!